13 Neobanks or Banking Fintech Organizations and you can What they Provide

Cutting-edge analytics and you may AI has allowed technology-driven websites banking to provide users having several helpful tips regarding the its deals, using and you can investment tips. Really neobanks provide their clients dashboard possibilities having significantly enhanced interfaces and you will rewarding, easy-to-know information on features including money, payables, receivables and you may lender statements. Of a lot conventional banking institutions features launched their own entirely digital plays, and fintechs has partnered that have conventional financial institutions to include banking characteristics.

- This can be one step regarding the correct assistance because usually help build collaboration and most likely repair the new missing trust of one’s young personal.

- Instead, it partner which have chartered financial institutions to provide bank account, financing, and wealth management services.

- Decision-making in addition to have to be stuck from the team’s results rubric and you may operating rhythms.

- Neobanks is to prioritize protection and you can visibility in connection with this, Collins told you.

That it past point ‘s they’s particularly important to ensure that one neobank with which your open a merchant account is federally covered. Be sure the fresh neobank you’re offered are identified by the brand new Federal Deposit Insurance policies Firm (FDIC), or worldwide people, protected by the brand new Economic Services Payment Strategy (FSCS) otherwise comparable regulating authorities. It ensures a qualification away from protection for the money you deposit to your mobile programs otherwise on the internet accounts. As a result to your rise in popularity of neobank platforms, dependent players features expose otherwise increased their things otherwise divisions in order to compete with the new nascent neobank community. Financing You to definitely 360, for example, try a no-percentage savings account with the exact same pros for example zero minimal harmony conditions.

Neobanking List: The state of Neobanks inside 2023

Asia Pacific is anticipated to appear since the quickest-growing local field over the anticipate several months. The fresh growing adoption from internet sites services, combined with the increased access to mobiles, is expected so you can accelerate the market industry growth. At the same time, things such simple and smoother financial services and the rise inside the digital-merely banking companies round the regions and The japanese, India, and you will China, are expected to further subscribe to the local business development. At the same time, the students class of the region are expected getting an enthusiastic additional work with for the adoption out of neobanks. The fresh Europe part reigned over the worldwide field in the 2022 and you may accounted for over 30.0% display of your around the world money.

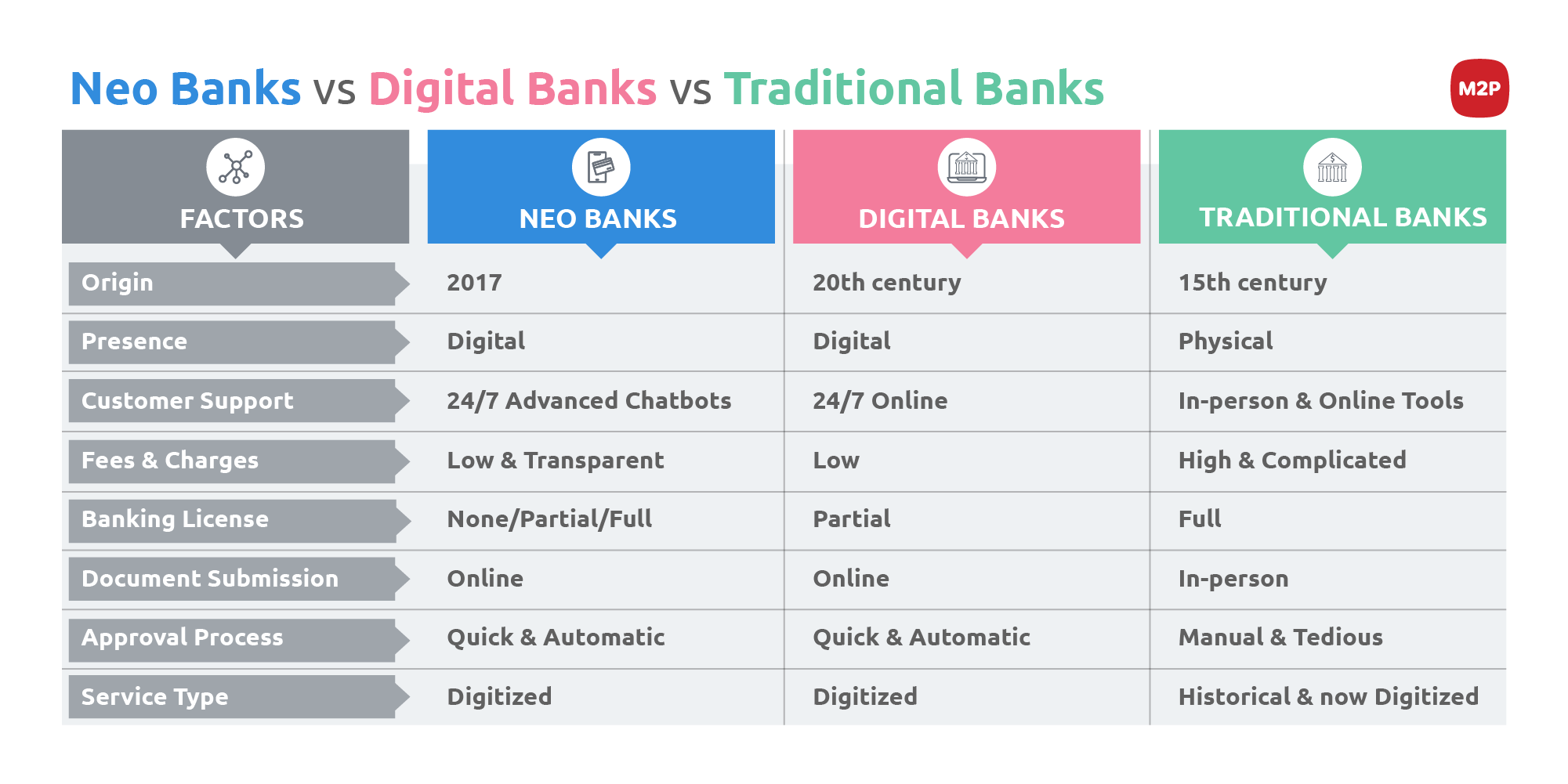

Neobanks try digital-first, definition they offer characteristics entirely on the web, while you are antique financial institutions render in the-individual features and you can digital characteristics, usually thanks to a mobile banking application. The big banking companies were slower with regards to the type to the brand new tech and you may modifying consumer needs; although not, start-right up digital banking companies had been amassing a huge member foot positively making use of their services. Furthermore, such initiate-ups try targeting developing characteristics which are without difficulty integrated that have team processes. Neobanks is actually difficult the newest common banking design using their individualized expertise, all the way down can cost you, user-friendly interfaces, predictive intelligence, easy accessibility, and you can simplistic process.

In a few implies, on the web banking institutions give you the better of both worlds — he or she is subscribed since the banking companies and also have FDIC insurance policies personally, but also typically give large-than-mediocre APYs, straight down (if any) costs, and you can condition-of-the-art financial programs and you will programs. The new quickly going forward electronic land has energized users with quite a few options for just about that which you, in addition to banking and cash administration. Today’s banking clients are searching for convenience, freedom, control, openness and quick results you to definitely aren’t supplied by of several antique banking companies. By the 2024, an estimated 40 million People in america are certain to get a minumum of one neobank account.

Types of Neobanks

Despite acquiring such strategies for performing full-stack digital banking companies, the fresh RBI seen particular dangers and uncertainty having held it right back https://neoprofit.pro/ of granting the new disperse. Stand alone or independent digital banks is the digital fingers out of a keen centered bank. It’s important discover a virtual banking license to perform a separate digital lender.

They could has unsealed only in the last ages, plus they you may fail, like any other startup or business. We believe folks should be able to build monetary decisions with confidence. And while our very own website doesn’t feature all team or financial device available on the market, we’re also proud that the advice you can expect, everything we offer as well as the devices we perform is mission, separate, easy — and you may 100 percent free. Because the government are directly monitoring the fresh “purchase now, spend later on” (BNPL) field, it offers no preparations away from managing it for the moment. NITI Aayog has just put out a discussion paper rooting for regulators so you can make it neobanks becoming fully subscribed electronic banking companies.

Dependent within the 2012, Chime is an excellent neobank one couples with a keen FDIC-insured financial and you can prioritizes financial health over payouts. It’s mobile-earliest checking account, offers accounts, and you will a good Chime Visa Debit Card. It has various monetary features, and bank accounts, debit notes, foreign exchange, stock trading, cryptocurrency, and you will peer-to-fellow costs. Unlike really neobanks, it has methods to one another people and you can businesses and you will supporting far more than simply 30 some other currencies.

Neobanks in addition to suffice people who have stayed away from traditional monetary associations on account of things like costs, minimum harmony standards, or insufficient a physical branch close. One of several causes neobanks have become therefore quickly is actually their ability in order to serve these earlier lender-averse users. The development out of neobanks provides triggered of several providing a wide list of characteristics while maintaining a similar affiliate-first experience. Varo are one of the primary neobanks to qualify because the a good full-services chartered lender. Varo also offers examining membership, savings profile, secure credit cards, and money enhances.

Just how do Neobanks Work?

Just like any sort of savings account, be sure to understand what charges you might be energized by an excellent neobank and check for FDIC insurance policies. Examine the huge benefits and you can restrictions from neobanks which have those of antique financial institutions to help make a knowledgeable choice regarding the when it might getting a good idea to switch-over from your own dated lender membership. To own people that not any longer pleased with the newest downsides from conventional banks, neobanks offer an option.

Unlike old-fashioned banking institutions and you may borrowing from the bank unions, which could offer digital portals whilst doing work actual branches, neobanks only provide its merchandise on line or because of a great cellular software. Traditional banking companies typically give numerous financial functions as well as examining and you can offers membership, auto loans, mortgage loans, handmade cards, and investment profile. Neobanks distinguish on their own of old-fashioned financial institutions by offering functions having lower or no fees and delivering equipment to protect financial wellness, such as overdraft security for free.

Using technology contributes to discount because they features a lot more automatic features, allowing neobanks for quicker group. This situation have intended that every of these the newest banks create not have to charge people fees, which is clearly appealing to customers. Neobanks constitute an alternative age bracket away from financial institutions that provide banking intermediation features in the an excellent 100% digital way. Growing regarding the digital conversion in the united kingdom and you will Germany, he has extended quickly in the Europe and are making the way to the Latin America lately.

Neobanks don’t face an identical controls because the normal banking institutions only because they’re perhaps not charted since the financial institutions having federal and state bodies. However, the consumer Monetary Security Agency provides established that it’ll much more supervise and regulate the game out of neobanks. Shop around for the advantages and disadvantages from on the internet banking prior to your choice. Having said that, an excellent neobank need to normally adhere to the companion bank’s very own requirements and you will methods, influenced by federal and state regulation. SoFi does not have any power over the message, products or services considering nor the safety otherwise privacy of information carried so you can anyone else thru the website.

Neobanking platforms must look into money, money alternatives, and you will financial educational equipment. Outside of the interior barriers one neobanks will get deal with, there is the issue on the financial literacy. Old years might not be comfortable with digital connects, and folks inside areas where there is minimal knowledge on the digital characteristics can be hesitant to adopt the new tech.